Maximizing Your Home Service Business: Navigating the Inflation Reduction Act's Impact on Home Upgrades

If you've been contemplating a home renovation, now might be the perfect time to take the plunge, and here's why: President Joe Biden's Inflation Reduction Act (IRA) is set to revolutionize the home improvement landscape.

This legislation, designed to incentivize eco-friendly upgrades, offers homeowners substantial tax rebates and credits, potentially saving thousands on their home renovations. But what does this mean for your home service business? Let's explore how the IRA can power up your business and how Spectrum's exclusive tools can help you capitalize on this unprecedented opportunity.

Understanding the Incentives:

The IRA introduces a slew of incentives for homeowners, spanning from energy-efficient appliances to solar panels. From tax credits for energy audits to rebates covering the installation of electric appliances, insulation, and solar panels, the opportunities for homeowners are extensive.

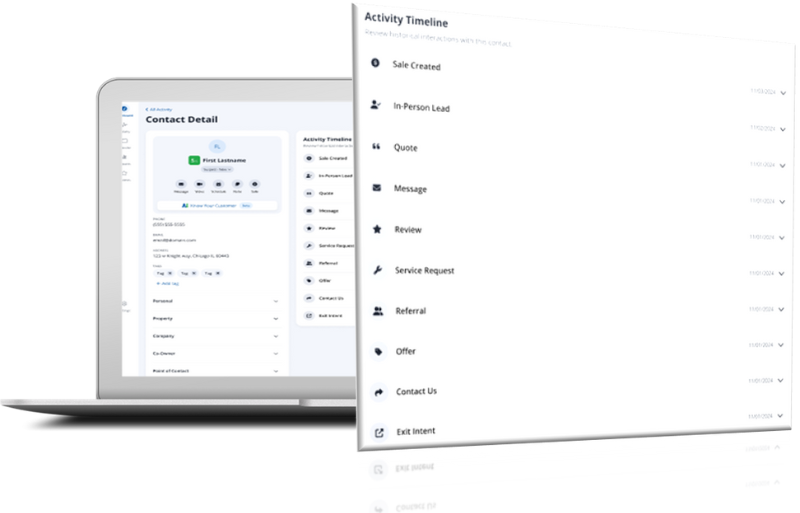

Powering Your Business with Spectrum's Tools:

Spectrum, with its exclusive suite of tools, is ready to guide your business toward maximizing the potential of IRA incentives. Here's a breakdown of how Spectrum's tools can help you stay ahead in the market:

- PSAI Software:

- Utilize Spectrum's PSAI technology to target the right customers effectively.

- Leverage Predictive Portraits™ to gain detailed insights into leads, giving your sales team a competitive edge.

- Website Offers:

- Highlight tax incentives through customized offers on your website, attracting local homeowners.

- Employ A.I. quote forms through PSAI to streamline the lead generation process.

- Exit Intent:

- Retain visitors and convert casual browsers into valuable leads with strategically timed, customized offers.

- Blog Content:

- Educate potential customers with informative blog posts from Spectrum's curated content library.

- Clarify the implications of the IRA for homeowners, turning uncertainties into closed sales.

Maximizing Home Energy Incentives:

Take a closer look at how homeowners can benefit from the IRA's energy efficiency incentives and how your business can be a key player in this transformative period:

- Electric Appliances:

- Homeowners can receive up to $8,000 in rebates for energy-efficient appliances.

- Low- and moderate-income families may qualify for rebates covering the entire cost of electric appliance installations.

- Insulation:

- Enjoy a 30% tax credit for energy-efficient insulation, including windows and doors.

- Low- and moderate-income households can receive up to $8,000 in rebates for heat pumps.

- Solar Panels:

- A 30% tax credit for rooftop solar panel installation is available until 2032.

- State incentives can further offset costs, potentially increasing the resale value of homes.

Navigating the IRA's Impact on Upgrades:

The Inflation Reduction Act presents an unparalleled opportunity for your home service business. By leveraging Spectrum's exclusive tools and staying informed about the diverse incentives under the IRA, you can position your business at the forefront of the market.

Now is the time to take action, empower your customers, and lead your business to new heights. Contact Spectrum's team today and schedule your free demo to embark on this transformative journey.